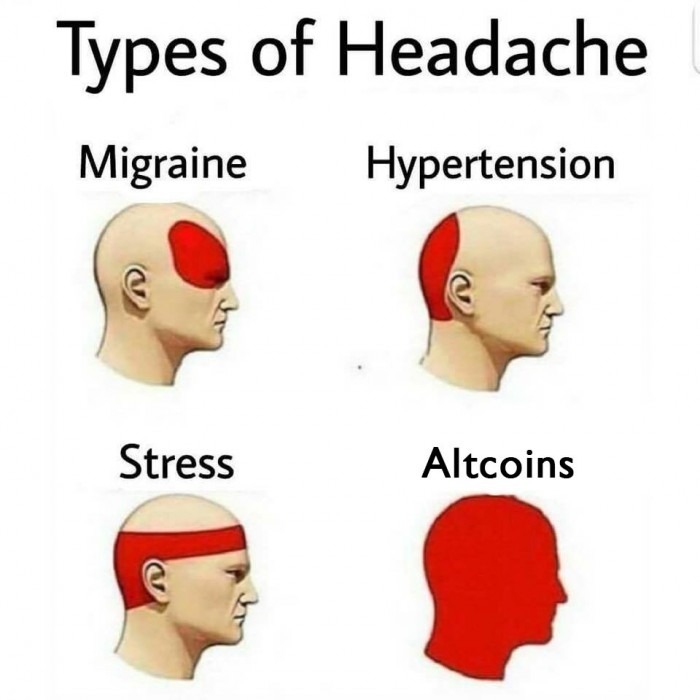

Cryptocurrency stress is a real thing. Continually worrying about price fluctuations will drive you insane. And not only that, but stress can have an adverse affect on your mental and physical health. So if you aren’t a day trader, scalper, or swing trader then I’ve created these tips to help make investing in cryptocurrency a stress-free endeavor.

Table of Contents

1. Don’t Invest More Than You Are Willing To Lose

This is absolutely the most important piece of advice that I can give you. Go ahead and imagine the money you have invested in cryptocurrency is as good as gone. If you treat it as if it is already gone then, if you actually do lose it, you will be way better prepared to handle the loss.

If you think this isn’t possible, this can and does happen. I know because it happened to me. Read my story here. I’ve also read stories of people mortgaging their houses to invest in crypto only to lose almost all of their money. Don’t put yourself in a position where it will cause cryptocurrency stress if you lose your money.

2. Stop Checking Prices

The cryptocurrency market is super volatile. The price fluctuations can be a roller coaster ride. If you feel the slightest bit of stress when checking prices then you need to stop. Try to set some limits. Maybe that’s checking prices only once every two weeks or once a month. You may even need to delete the price checker or portfolio app from your phone completely. This is probably one of the biggest things you can do to control cryptocurrency stress.

3. Don’t Go All In On One Coin

Spread out your investments. This may look something like picking 10 to 20 coins and investing a little bit in each. This will greatly reduce your risk, especially when one coin goes to zero. If you don’t think this can happen then you didn’t read my story that I linked to earlier. You can read about it here.

4. Consider Reblancing

One way traders reduce risk to use a technique called rebalancing. Rebalancing is the process of periodically buying and selling your coins to maintain a desired percentage in each one.

For example, say you have 10 coins and you are investing 10% of your money in each one. When the value of one coin rises, you take the profits from that coin and put it into the others making sure all your coins have 10% again. This greatly lowers the risk of your overall investment.

In crypto, there are tools that will do this for you. One tool that does this is Shrimpy. They even have a backtest tool so you can see how much better rebalancing would have been verses just holding.

The downside is, if you are in the US or other countries that tax you based on each trade, each rebalancing action will trigger a trade and thus a taxable event.

5. Consider Holding For A Year Or More

Or instead of rebalancing, you could just buy a set of coins and hold them for a year. The benefit of this is that in the US and other countries you aren’t being taxed on each trade. You will just be taxed based on your long term loss or gain when you finally sell or cash out.

This method obviously reduces your stress level as well because you are not constantly worried about whether you should trade your current coins for others. You can consider this the set it and forget it method.

6. Pull Out Your Initial Investment

Once you have made your money back and some more, pull out your initial investment. This way everything you make beyond that is profit. You no longer have to worry about whether or not you will see that money again.

7. Consider Buying High-Cap Coins

High-cap coins or coins with a high market capitalization are the least riskiest coins available. This list would probably include the top 15 coins on CoinMarketCap.com with Bitcoin being number 1. These coins are the least prone to wild market swings (if there is such a thing in crypt0) and typically make steady gains over the course of several years. Think of this as a conservative investing strategy that will greatly help to reduce cryptocurrency stress.

The cyrptocurrency market is highly volatile and super risky. Following these tips will help you on your journey to stress-free cryptocurrency investing.

What tips have helped you or others? Please post them in the comments below.